Excelling on the CAHPS Health Plan Survey has incredible benefits: It leads to improved Medicare Star scores, increased revenue, and increased enrollment for a health plan organization. But having the right information to improve performance on CAHPS can be challenging. Here at Decision Point, we have developed a data-driven solution to boost survey performance. In this series of interviews, we look at three key elements of a CAHPS improvement strategy. Let’s start with personas.

What are personas, and why should an organization that wants to improve their CAHPS survey performance care?

Personas are representations of members of a health plan that are built on market experience and actual data about those existing members. In this case, CAHPS survey response personas are personas that help us understand and take action on the population eligible for the CAHPS Health Plan Survey. The goal is to elevate member perception of access and satisfaction in order to positively impact how that population will respond to the survey. We take a data-driven approach when creating CAHPS survey personas, including member demographics, clinical and non-clinical behavior patterns, consumer behavior, and psychosocial traits.

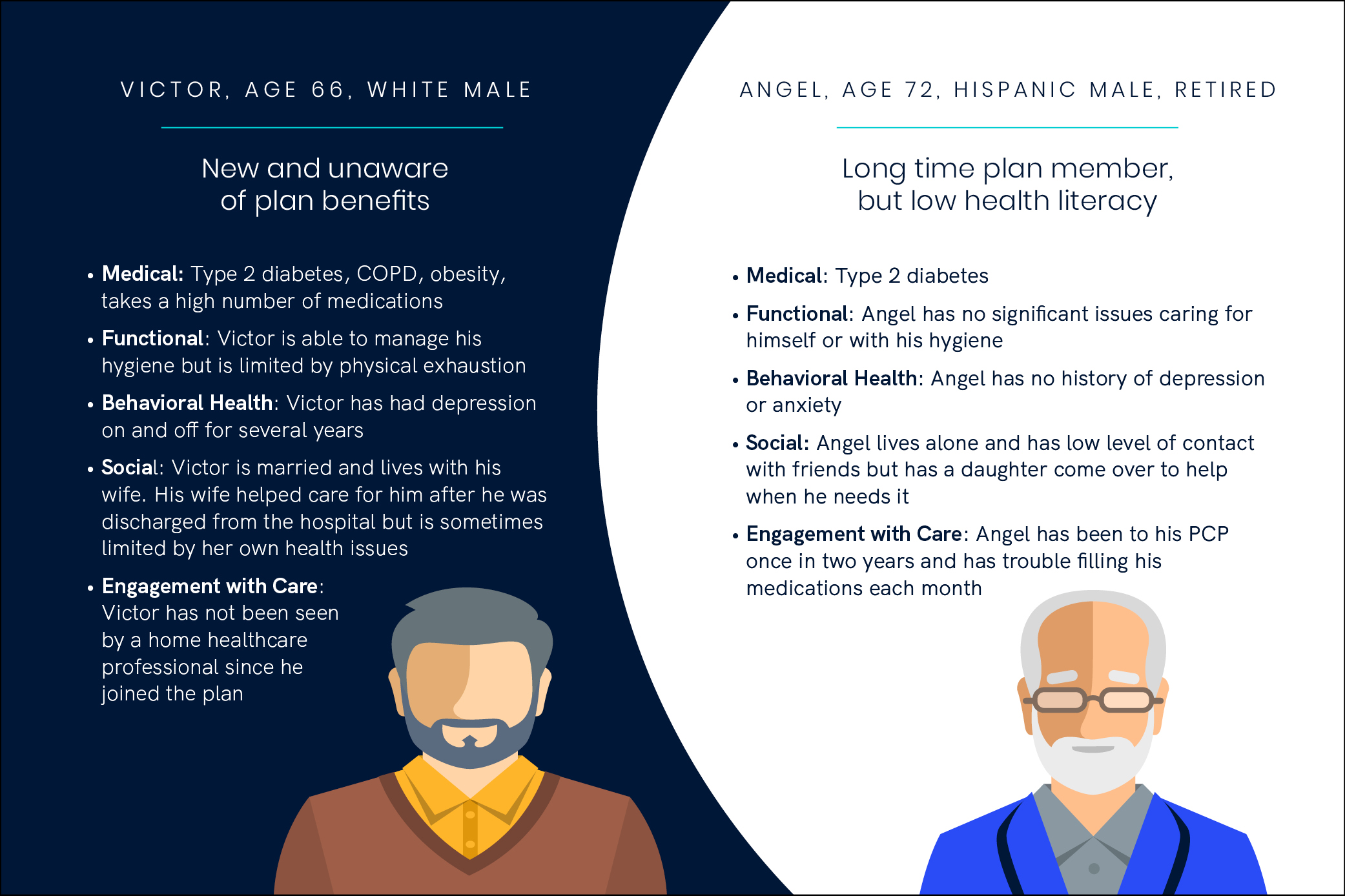

Let’s look at an example. We might be interested in impacting responses to access-related CAHPS items, such as Getting Specialist Appointments or Getting Non-Urgent Appointments and Care Quickly. Members that respond negatively to these questions tend to go out of network frequently, use inpatient and emergency services when not necessary, and have trouble adhering to their medications. But if we drill down in the data we can start to see two distinct clusters — two very different personas emerge: (1) members that are new to the plan and unaware of plan benefits and the network (2) members that are not necessarily new to the plan but have health literacy barriers impacting their decisions. Let’s call these personas “Victor” and “Angel”, respectively, and meet them (see figure below).

Wouldn’t you approach Victor and Angel differently if you wanted to change their perception of how the plan supports their access to care? Because we can identify personas, we can differentiate members that otherwise appear to have the same issues.

These personas sound a lot like traditional marketing personas. How are they different?

That’s fair. The key difference, though, is that marketing personas tend to be semi-fictional and are used to drive a creative process whereas Decision Point survey personas are purely data-driven – they’re defined with rigor and precision by the data we have, which includes everything from individual claims data and pharmacy data to consumer and census data. Through analysis, we can identify personas by seeing which characteristics cluster together when we look at things like survey response behavior. These may differ from plan to plan, but some personas are fairly universal, like Victor and Angel – Victors and Angels tend to make up close to half of the members likely to respond negatively to access related CAHPS questions.

How does a member’s CAHPS persona compare to our understanding of their other behaviors?

Because we are accounting for behaviors like treatment adherence and engagement with primary care when developing these personas, we see that survey response personas are very tightly correlated with more traditional healthcare-related behaviors. In other words, the Angels in the population are not only more likely to rate the plan negatively but are also less likely to follow through on an annual wellness visit or adhere to their diabetes medications.

What’s really interesting is when we start to look at the overlap between these personas and behaviors like their likelihood to stay enrolled on the plan. For example, the Victors in the population are much more likely to voluntarily leave the plan compared to other members.

We also see that our survey response personas map well onto Net Promoter Scores as well as onto a member’s propensity to even respond to a survey, should they be sampled. So, personas can be extremely versatile and useful if married with predictive analytics.

What would that look like, combining personas and predictive analytics? Say you’ve identified personas in your membership, what’s next?

Personas are great. They’re informative and help us to understand a population – but they’re not actionable in and of themselves if your organization’s goal is to improve performance on CAHPS survey results. You still don’t know which Victors will rate the plan negatively. That’s where predictive analytics comes in, where we can determine a member’s likelihood to respond negatively to a CAHPS survey item and marry that information with a member’s survey response persona to know who to reach out to, how, and when.

Stay tuned for more on how to elevate CAHPS next week, where Lisette and I dig deeper into how personas and predictive analytics work together to help create a tried and true CAHPS improvement strategy that really works.